Mastering Mortgage Servicing: Strategies for Superior Quality and Compliance

Self-assess and improve your credit union’s quality in your mortgage servicing operations

Access the GuideRead white papers, guides, checklists and more authored by our team of quality and compliance experts

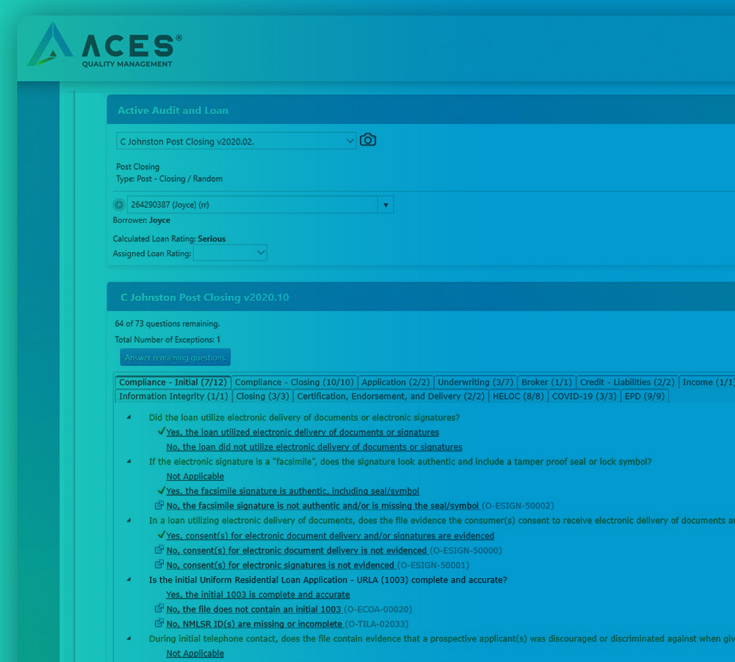

ACES Quality Management takes education seriously and feel compelled to share our collective experience and insights in loan quality with our colleagues and peers. ACES subject matter experts and clients continue to grow our library of guides, sharing their expertise and best practices on loan quality control.

Self-assess and improve your credit union’s quality in your mortgage servicing operations

Access the GuideThroughout this comprehensive 15 step guide, we dissect each facet of the QC plan, providing valuable insights, practical recommendations, and actionable steps. This guide aligns with industry requirements and best practices, ensuring credit unions remain steadfast in their commitment to quality within the ever-evolving landscape of financial services.

Access the GuideIn this playbook, you'll discover the three key lines of defense for maintaining servicing loan quality and how you can refine each to:

In today's lending landscape, shifting the mindset from QC as a “no news is good news” role to a powerful, proactive source of improvement may separate profit winners and losers. In this eBook, find out how forward-thinking lenders have turned QC into a real-time feedback mechanism, driving continuous improvement to both revenue and cost.

View the E-BookA credit union’s #1 mission is a quality experience for its members. Managing originations and keeping up with regulatory changes across digital channels, indirect auto dealers, mortgage loans, call center, and in-person branches can be challenging. Today, credit unions must break free from antiquated spreadsheets and build an automated quality control plan that supports the rapid change of today’s lending environment. If your loan quality is compromised, it can affect your liquidity and increase risk when it comes to safe and sound compliance practices.

Download the ChecklistThis infographic helps illustrate the many ways ACES Quality Management and Control Software allowed ACES customers to achieve proven, measurable return on investment.

Access the InfographicThis checklist was designed to help mortgage quality control professionals assess their current QC process. Whether you are outsourcing your QC, managing QC in-house through an audit technology software, or running your own in house QC process, it is important to evaluate if this process is the most efficient and successful in meeting the needs of your orga

Download the Checklist