An Enterprise-Grade Solution for Managing Loan Quality and Mitigating Risk

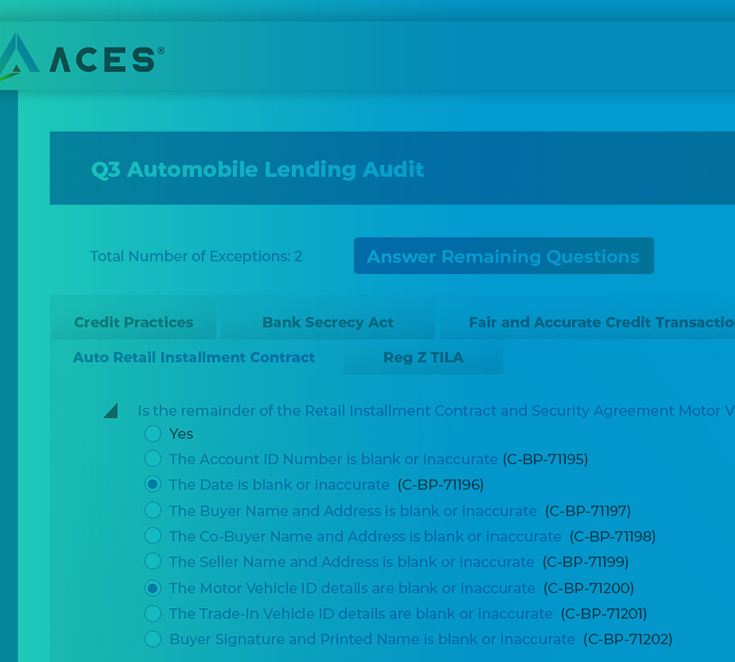

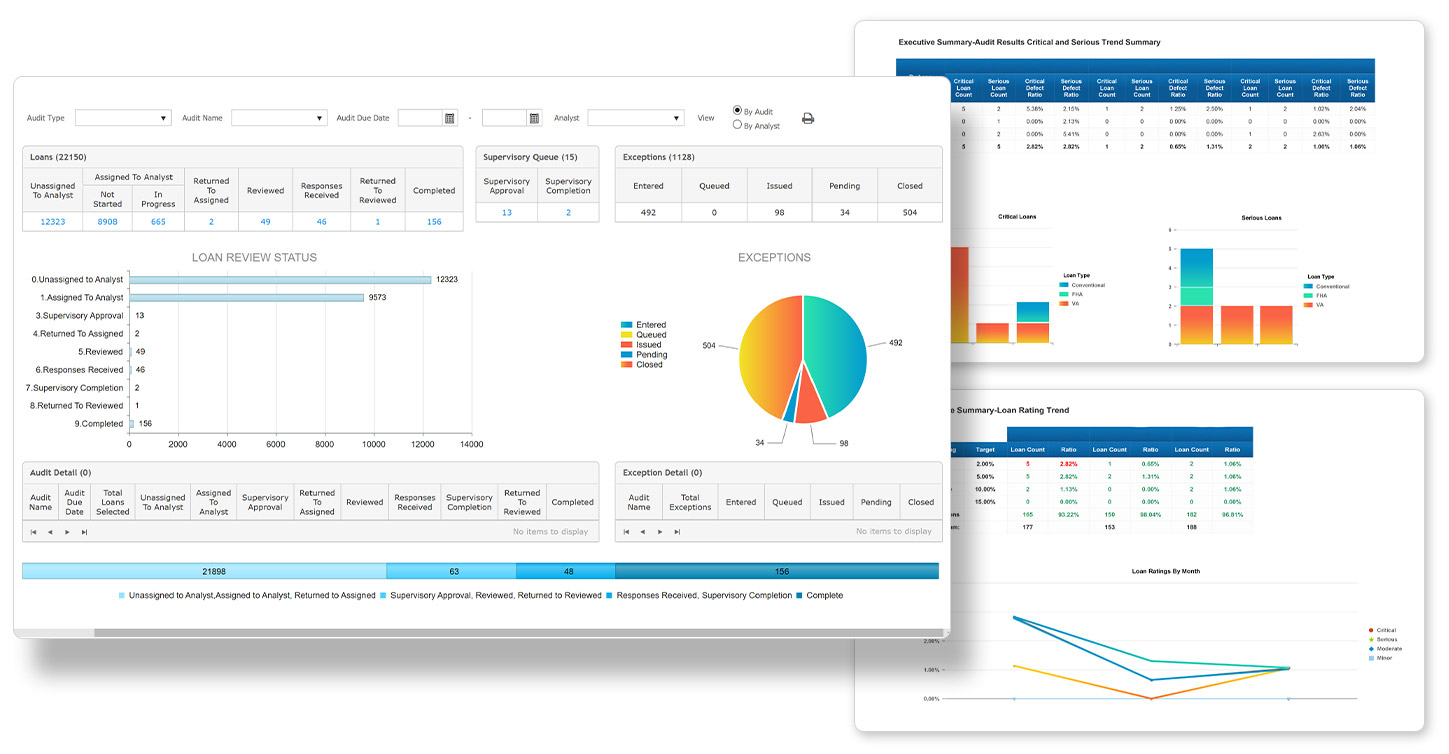

Quality is central to the Credit Unions mission to help members. With ACES Quality Management and Control, Credit Unions can leverage a single platform to obtain a holistic view of loan quality, apply compliant checklists, and gain valuable quality insights across both deposit account opening, consumer, and mortgage lending channels.

Learn more about ACES