POMPANO BEACH, Fla., May 1, 2019 — ACES Risk Management (ARMCO), the leading provider of enterprise financial risk mitigation solutions, has announced that it has hired Kyle Kehoe as chief revenue officer.

Kyle’s focus will be accelerating ARMCO’s organic revenue growth, from its strong base in the mortgage vertical into adjacent markets in financial services, both commercial and consumer. He will also help guide the development and commercialization of ARMCO’s next generation of products and services, and ensure the company continues to deliver best-in-class customer experiences.

Across his 20-year career as an executive and revenue leader with CRIF Lending Solutions/MeridianLink, Yodlee and Equifax, Kyle has built and led exceptional enterprise sales, product and marketing teams.

“We are proud to announce Kyle as ARMCO’s chief revenue officer, and thrilled to have him on our executive team,” said Avi Naider, ARMCO’s CEO. “His strategic vision, industry leadership, commercial acumen and personal integrity are the qualities we seek in our executive team.”

“As provider of the most advanced quality control and compliance technology, ARMCO is in prime position for expansion,” said Kyle Kehoe, CRO. “I look forward to helping lenders, servicers, banks and other financial institutions achieve the increased revenue, reduced risk, and enhanced client experiences that come from choosing ARMCO as a technology partner.”

“I believe we drafted a high-impact player in Kyle, one who has delivered results across two decades and through some tough industry cycles,” said Phil McCall, ARMCO’s president.

ABOUT ARMCO

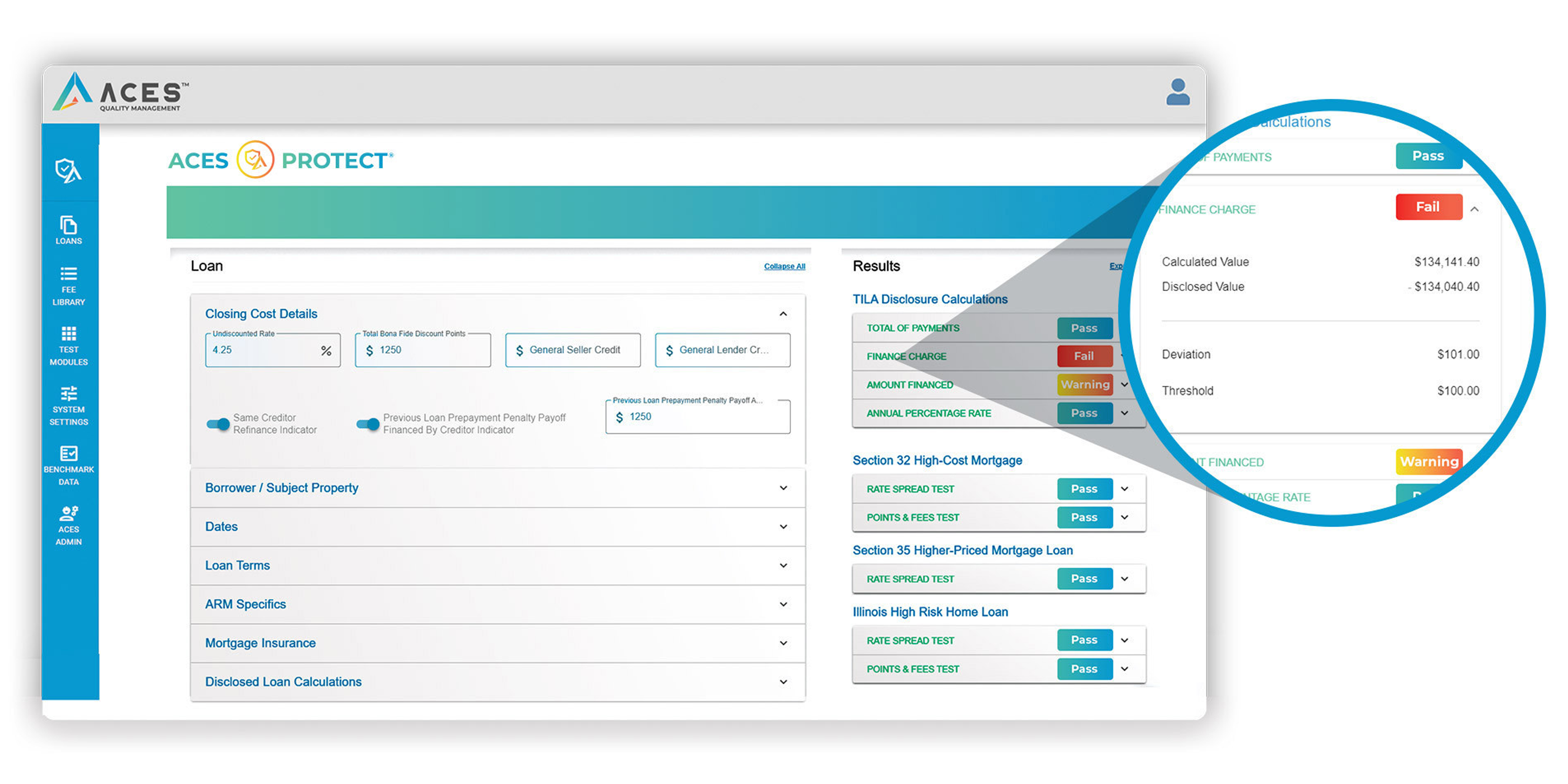

Over half of the top 20 mortgage lenders in the U.S. choose ARMCO as their provider of risk management software. ARMCO’s product line includes loan quality enterprise software, services, data and analytics. Its flagship product, ACES Audit Technology™, has set the bar for user definability in its category. It is used at virtually every point in the mortgage lifecycle, as well as for a wide range of risk-prone business operations outside traditional mortgage origination and servicing. ARMCO’s consultative approach to customer relationships leverages 25 years of mortgage risk intel, assuring that its clients are using the most effective risk mitigation strategies, and are using the fastest, most reliable, most efficient means for preventing risk-related loss. ARMCO distributes the ARMCO Mortgage QC Industry Trends Report, a free quarterly analysis of industry-wide mortgage loan quality. For more information, visit www.acesquality.com or call 1-800-858-1598.

PRESS CONTACT

Jeri Yoshida

Yosh Communications

jeri@yoshcomm.com

310 651 0057