Click to read the full bill.

Compliance Newshub

State News

This topic consolidates legislative summaries of new and revised state laws pertaining to licensing, originating, and servicing mortgage loans.

This topic consolidates legislative summaries of new and revised state laws pertaining to licensing, originating, and servicing mortgage loans.

Click to read the full bill.

Click the link to read the full Act.

Search our Compliance Calendar for current regulatory changes & updates.

Click to read the full bulletin.

Click the link to read the full article.

Click the link to read the full article.

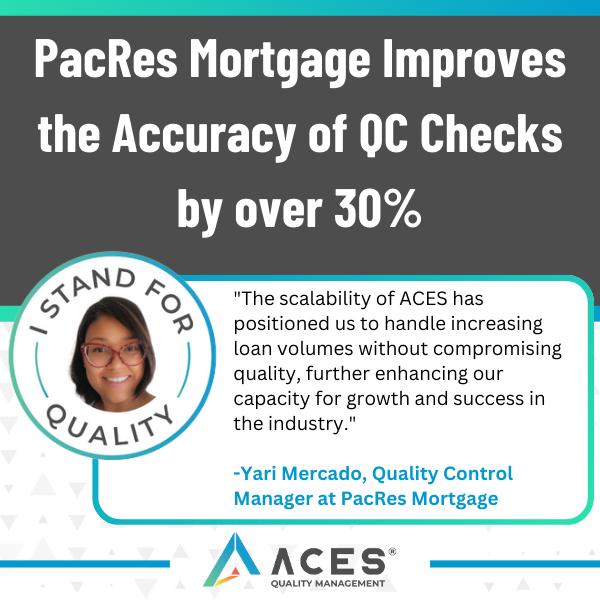

PacRes Mortgage Improves Quality Control Accuracy by over 30% While Decreasing non-compliance incidents by 25%

Click the link to read the full article.

Click below to read through Senate Bill 24-205.

Click the below link to read the full article.

Click the link to read the full bill text.

"ACES has made my life so much easier from a QC perspective. It's life-changing"

- Kelly Cooper Spencer, QC & Business Intelligence Data Manager at Thrive Mortgage

Click the link to read the full article.

Click below to read the full article.

The State of New Jersey immediately amends provisions regarding foreclosure procedure and the Community Wealth Preservation Program.

On Tuesday, December 26th, 2023, the Ohio Department of Commerce announced the annually adjusted loan limit amount for assessing penalties for prepayment or refinancing of mortgage loans to no less than $110,223, effective on January 1st, 2024.