M Report – Christin Espinosa

According to Freddie Mac's latest Primary Mortgage Market Survey, the 30 year- fixed-rate mortgage increased slightly from last week.

This topic consolidates the latest industry publications pertaining to natural disasters, including FEMA declarations, agency issuance's, and impact analyses from top industry providers.

M Report – Christin Espinosa

According to Freddie Mac's latest Primary Mortgage Market Survey, the 30 year- fixed-rate mortgage increased slightly from last week.

MReport – Christina Hughes Babb

According to the United States Census Household Pulse Survey, showed some 9.9 million Americans had little to no confidence that their household would be able to afford next month's mortgage or rent payment related to the COVID-19 pandemic.

Search our Compliance Calendar for current regulatory changes & updates.

Mortgage Professional America

According to CoreLogic's latest estimate, Hurricane Zeta caused billions in damages to residential and commercial properties.

DS News-Christina Hughes Babb

The JDSupra legal news sites provide the most-recent statewide updates on Foreclosure and Eviction Moratoria.

DS News – Christina Hughes Babb

According to a report from Urban Institute research associate Steve Brown, minority households continue to suffer disproportionately from COVID-19 fallout.

MReport – Cristin Espinosa

A new Zillow survey shows how the COVID-19 pandemic may be responsible for the recent lack of a home for sale.

PacRes Mortgage Improves Quality Control Accuracy by over 30% While Decreasing non-compliance incidents by 25%

Mortgage Professional America – Candyd Mendoza

According to the latest survey from United Wholesale Mortgage (UWM), the mortgage industry remains at the peak of a COVID-led refinance boom.

Freddie Mac Bulletin 2020-40 extends the effective date for the following temporary flexibilities for mortgages with application received dates through November 30, 2020: employed income 10-day preclosing verifications; appraisal and GreenCHOICE Mortgages®; condominium projects; and power of attorneys.

Fannie Mae has updated LL-2020-04 to the application dates eligible for these temporary flexibilities to November 30, 2020, unless otherwise noted.

Fannie Mae has updated LL-2020-03 to extend the verbal verifications of employment and power of attorney flexibilities to November 30, as well as move the remote online notarization policies into the Selling Guide.

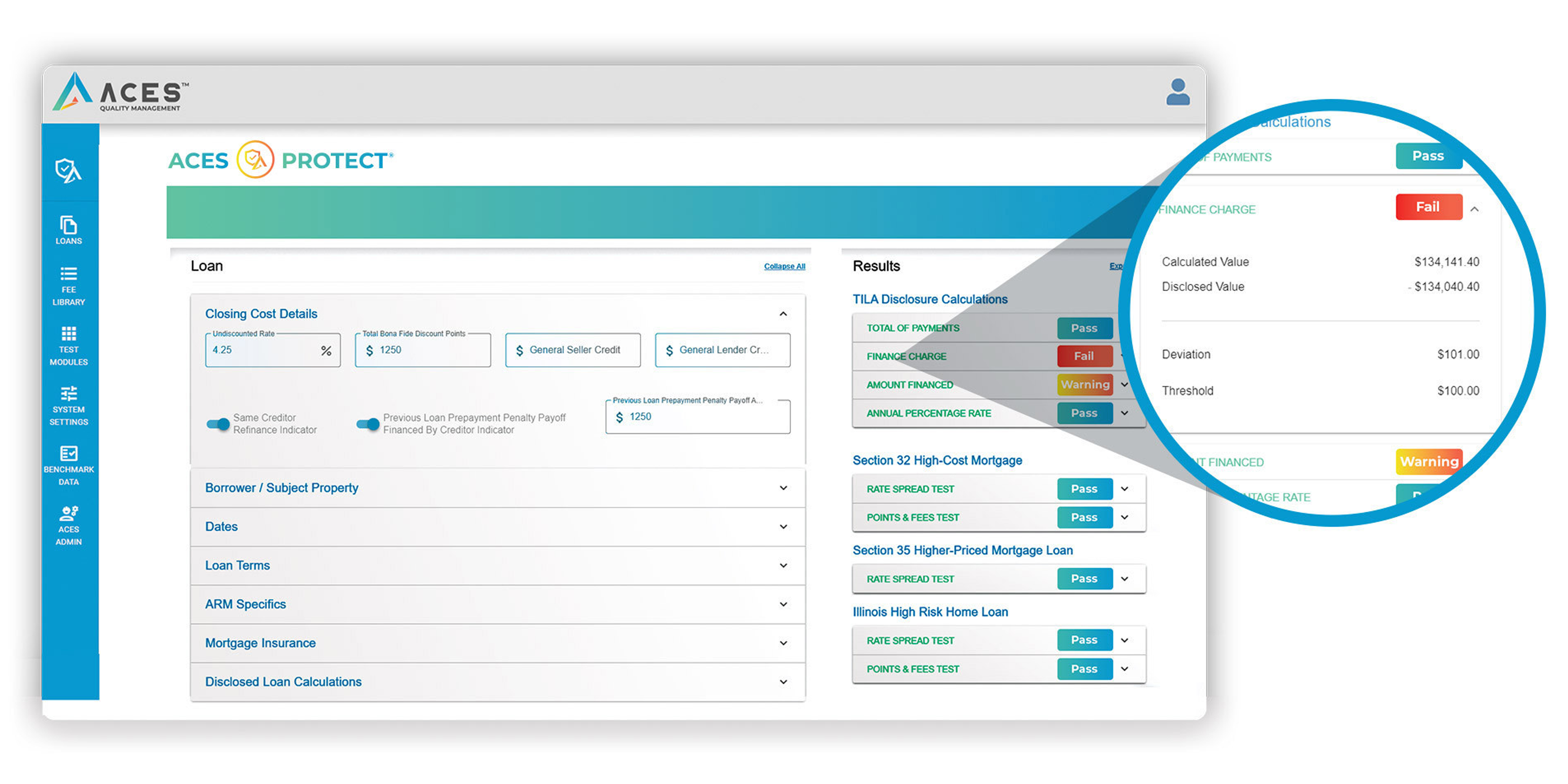

Automated compliance tests to ensure compliance on more loans in less time

Fannie Mae has updated LL-2020-07 to clarify when a borrower who accepts a COVID-19 payment deferral remains eligible for any future HAMP “pay for performance” incentives and clarify that a mortgage loan with an origination date after Mar. 1, 2020, the effective date of the National Emergency Declaration, does not exclude it from COVID-19 payment deferral eligibility.

Fannie Mae has updated LL-2020-02 to clarify servicer requirements related to disbursing insurance loss proceeds for

borrowers impacted by COVID-19 and clarify when a borrower impacted by COVID-19 remains eligible for any future

HAMP “Pay for Performance” incentives.

DS Bews – Phil Hall

According to the latest report by Black Knight’s McDash Flash Forbearance Tracker, the number of mortgages in active forbearance saw its most significant drop since the pandemic began.

Mortgage Professional America – Duffie Osental

According to Zillow's latest report, women are more likely to face housing insecurity from the economic impact of COVID-19 than men.