FDIC announced a series of steps intended to provide regulatory relief to financial institutions and facilitate recovery in areas of Florida affected by Hurricane Sally.

Compliance Newshub

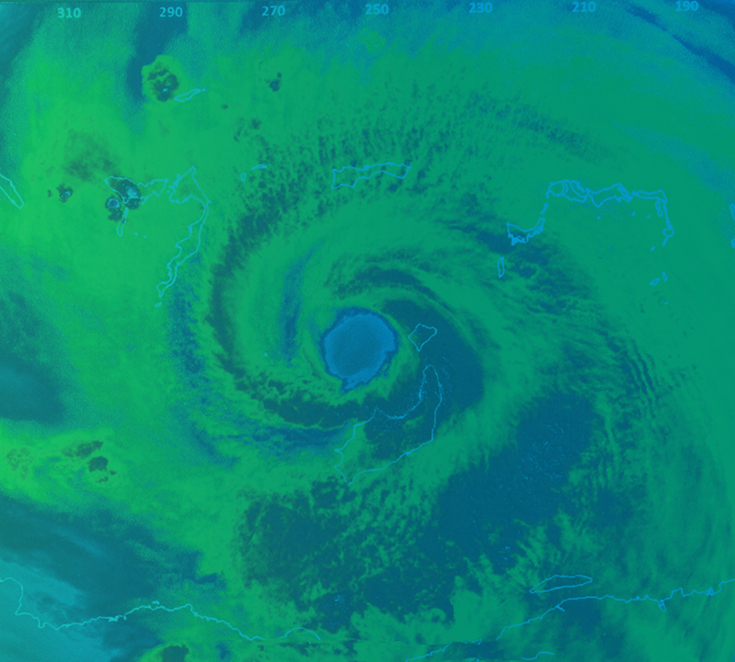

Disaster News

This topic consolidates the latest industry publications pertaining to natural disasters, including FEMA declarations, agency issuance's, and impact analyses from top industry providers.