FinCEN issued a notice regarding reporting COVID-19-related criminal and suspicious activity and reminding financial institutions of certain Bank Secrecy Act (BSA) obligations.

Compliance Newshub

Disaster News

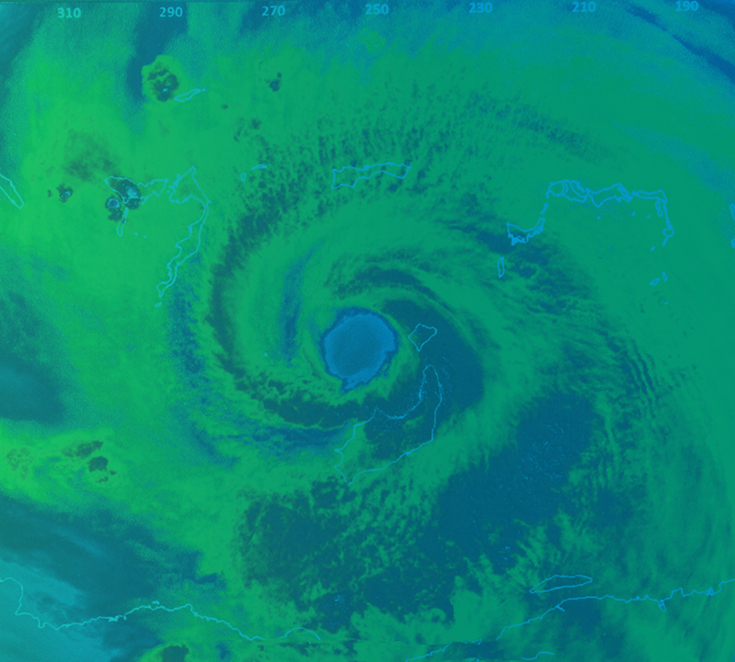

This topic consolidates the latest industry publications pertaining to natural disasters, including FEMA declarations, agency issuance's, and impact analyses from top industry providers.