Fannie Mae has updated LL-2020-02 to updated the reclassification process for mortgage loans pooled under the Amended and Restated 2007 Single-Family Master Trust Agreement in response to the Coronavirus Aid, Relief, and Economic Security Act on Mar. 27, 2020 (“CARES Act”), when a borrower impacted by COVID-19 is provided a forbearance plan.

Compliance Newshub

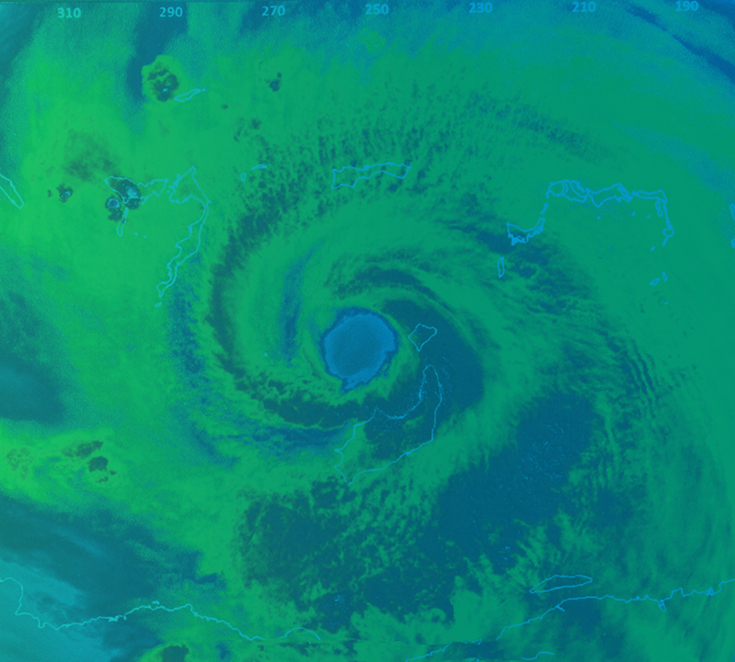

Disaster News

This topic consolidates the latest industry publications pertaining to natural disasters, including FEMA declarations, agency issuance's, and impact analyses from top industry providers.