The NCUA released a letter to federally insured credit unions to address temporary relief available as a result of Covid-19, including: access to NCUA’s Central Liquidity Facility; details on two real estate appraisal rules approved by the Board to provide regulatory relief for credit unions; an increase of the maximum aggregate amount of loans a credit union can purchase from one lender without a waiver; and suspension of the required timeframes for the occupancy or disposal of properties not being used to conduct business or that have been abandoned.

Compliance Newshub

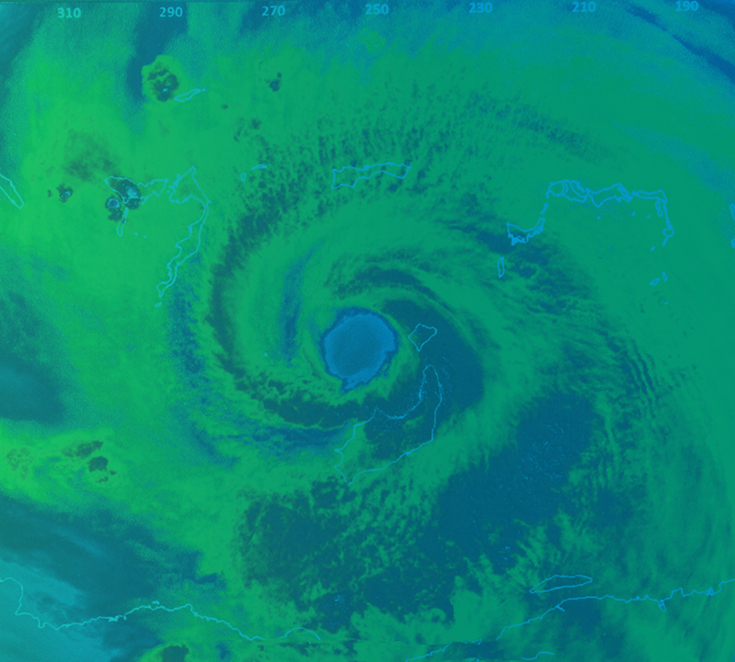

Disaster News

This topic consolidates the latest industry publications pertaining to natural disasters, including FEMA declarations, agency issuance's, and impact analyses from top industry providers.