DSNews--Radhika Ojha

Industry experts share lessons learned from past disasters and talk technology solutions to better prepare for assisting homeowners through future disasters.

This topic consolidates the latest industry publications pertaining to natural disasters, including FEMA declarations, agency issuance's, and impact analyses from top industry providers.

DSNews--Radhika Ojha

Industry experts share lessons learned from past disasters and talk technology solutions to better prepare for assisting homeowners through future disasters.

DSNews--Radhika Ojha

DSNews reports that the 2019 hurricane forecast has increased from 13 to 14 storms, based on a projection from Colorado State University.

Search our Compliance Calendar for current regulatory changes & updates.

DSNews--Seth Welborn

On Monday, the House of Representatives voted to pass H.R.2940, which provides $19.1 billion in recovery funds for disaster-affected areas including Puerto Rico. The House passed the bill after a 10-day recess, voting 354-58. As the Senate had already voted to pass the bill 85-8 on May 23, the bill will now move on to President Donald Trump for his sign-off.

"We must work together quickly to pass a bill that addresses the surge of unaccompanied children crossing the border and provides law enforcement agencies with the funding they need," said top Appropriations Committee Republican Kay Granger of Texas on Fox News. "The stakes are high. There are serious—life or death—repercussions if the Congress does not act."

U.S. Reps. Randy Weber and Lizzie Fletcher introduced the Bipartisan Disaster Recovery Funding Act in May with support from 13 other co-sponsors from Texas, mostly from the Houston area, as well as supporters from other communities waiting on the funding, including Louisiana, South Carolina, Florida, and Puerto Rico.

The Act directs federal agencies to release the $16 billion in disaster funds Congress approved in early 2018 following Hurricane Harvey to different states and territories—including more than $4 billion to Texas—within 60 days.

“After Harvey hit, I fought alongside the Texas delegation to secure additional funds for Harvey survivors,” said U.S. Rep. Mike McCaul. “Unfortunately, the agencies tasked with distributing these funds did not respond with the same urgency.”

According to the Texas Tribune, Texas has already received billions of dollars for Harvey recovery, but each bucket of money is designated for a specific purpose. The $4.3 billion that Congress approved for Texas last February is part of a HUD grant program designed "to help cities, counties, and States recover from Presidentially declared disasters, especially in low-income areas."

The Five Star Conference will host its Disaster Preparedness Symposium on July 31 in New Orleans, Louisiana. Natural disasters impact investors, service providers, mortgage servicers, government agencies, legal professionals, lenders, property preservation companies, and—most importantly—homeowners. The 2019 Five Star Disaster Preparedness Symposium will include critical conversations on response, reaction and assistance, to ensure the industry is ready to lend the proper support the next time a natural disaster strikes.

MBA Insights--Ed Marcheselli

Ed Marcheselli is managing director of Learning & Development for BAI, Chicago, a nonprofit, independent organization that delivers actionable insights for the financial services industry.

What will be the most expensive natural disaster this year? Based on winter 2018-19 being the wettest on record in the United States, the NOAA predicts it could be flooding.

In an April report, the Weather Channel anticipates large parts of the country could be facing significant flood risks this summer, due to the already saturated soils and accounting for even an average-impact hurricane season.

With the Mississippi and Ohio River Basins already dealing with flooding earlier this spring, and a significant percentage of the country facing an elevated risk of flooding this summer, mortgage professionals need to be diligent about providing efficient and effective employee training in order to comply with the Flood Disaster Preparation Act of 1973.

Flood insurance is a critical component of any loan on a commercial or residential property that sits in a high-risk flood zone. Since most homeowners' insurance policies do not specifically cover flood damage, regulators require special policies and expect lenders to determine whether the loan requires coverage.

Mortgage leaders may ask, "What is the consequence of not following FDPA regulations?" Currently, the penalty is $2,000 for each violation with no accrued maximum--not to mention the financial losses that result from flood damage to an uninsured or underinsured building.

While the law itself has been in effect for more than four decades, the criteria for determining eligibility and the regulations outlining borrower communication are constantly shifting. Common violations can include failing to determine the property's flood zone status, failing to maintain insurance through the life of the loan and failing to notify borrowers of flood insurance requirements. Mortgage leaders should build FDPA compliance training into their annual professional development plans to ensure that they are compliant with the latest regulatory expectations.

Recent Developments in FDPA Requirements

FDPA has been revised many times over the years. On average, Congress amends it about once a decade, including reforms outlined in the National Flood Insurance Reform Act of 1994, the Biggert-Waters Act of 2012 and the Homeowner Flood Insurance Affordability Act of 2014.

Most recently, the Office of the Comptroller of the Currency and the Federal Reserve released a final rule offering guidance to financial services organizations related to the acceptance of private flood insurance for properties in special flood zones. The challenge the revisions attempt to address is that over the decades, flood insurance has become one of the most expensive settlement costs faced by borrowers, potentially ranging between $200-500 per month in addition to the mortgage payment. Lenders are also limited in which insurance companies they can accept flood policies from due to the legal definitions of an accepted plan.

Effective July 1, however, financial services organizations will have more flexibility in defining the standards needed to meet the legal definition of "private flood insurance." This should enable mortgage professionals to have a broader choice of prices and coverages that still protect the property without disqualifying some borrowers due to the additional costs of mandated insurance.

Training Lenders to Communicate FDPA Requirements to Borrowers

It is important that mortgage leaders ensure their FDPA training includes educating lenders on how to communicate necessary information with borrowers. For example, lenders must provide a written notice of special flood hazard areas to a borrower--and receive acknowledgement of the notice from the borrower--at least 10 days prior to closing to enable time to obtain a suitable policy. Without evidence of proper flood insurance, the closing must be delayed. This notice is required to be retained for the life of the loan.

Additionally, while many borrowers assume their real estate agent will let them know if they are in a flood plain, it is actually the lender's responsibility to determine the flood status and to notify borrowers within a reasonable time before loan closing.

Other areas of confusion arise around topics such as escrow. The FDPA requires lenders to specifically include flood insurance premiums in the escrow for general insurance and taxes. Additionally, once a policy has been identified, lenders must communicate with the borrower if it is determined that the policy is insufficient to cover the cost of the property. This applies even if the determination occurs after closing, such as if new flood zone maps move a property into a flood zone. If the borrower refuses the coverage or fails to purchase appropriate insurance within 45 days of notice, lenders are required to purchase, or force-place, the insurance on their behalf.

Under the Biggert-Waters Act, lenders can charge the borrower for their costs. However, if a homeowner proves existing flood insurance coverage, the lender must terminate the force-placed insurance within 30 days of receipt.

The easiest way to ensure compliance is to build FDPA training into an organization's regular development schedule. Lenders can leverage compliance training courses that can be conducted online or in person. Ensuring mortgage employees have the training necessary to follow FDPA guidelines can build a levee to protect against the fines and regulatory actions for rising flood insurance requirements.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA Insights welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)

DSNews--Seth Welborn

As hurricane season begins, CoreLogic takes a look at where homeowners will be at the highest risk by metro areas. According to CoreLogic, there are three main components to a hurricane: wind, precipitation and storm surge.

“Though wind is generally thought of as the primary contributor of hurricane losses, this is not always the case,” said Tom Jeffery, Principal, Insurance and Spatial Solutions, at CoreLogic. “Throughout history, damage from storm surge and inland flooding has shown it can far exceed damage from wind. Superstorm Sandy, for instance, caused unprecedented levels of storm surge in New Jersey and New York.”

CoreLogic’s data analyzes where homes will be at the most risk for damage from a storm surge. According to the data, Miami, Florida, tops the list of cities at risk for storm surge for single-family homes, followed by New York City and Tampa, Florida.

“Due to the concentration of residences in and around large metro areas, 15 [core-based statistical areas] account for 67.5% of the total number of homes at risk of storm surge in the United States. Additionally, the reconstruction cost value (RCV) for these 15 metro areas represents 68.9% of the total RCV for storm surge risk in the United States.”

The Impact of Disaster

A report from the Urban Institute notes that damage from natural disasters leaves a negative impact onhomeownership long afterward, and that the negative effects of disasters persist, or even grow over time, for important financial outcomes.

Learn more about how to prepare for natural disasters at the 2019 inaugural Five Star Disaster Preparedness Symposium, July 31 at the Hotel Monteleone in New Orleans. The Symposium provides an opportunity for national leaders and executives to engage in critical conversations on diligence and preparedness, so the next time a natural disaster strikes, the industry will be ready to lend the proper support. Register for the Symposium here.

DSNews--Mike Albanese

Residents in Dayton, Ohio, have been left to pick up the pieces after three tornadoes caused widespread damage on Monday.

It was reported by ABC News that more than 80,000 people—more than half of Dayton’s reported population—were left without power early Tuesday morning. The storm has caused one confirmed death.

"I don't know that any community that is fully prepared for this type of devastation," Dayton Assistant Fire Chief Nicholas Hosford said Tuesday on ABC's "Good Morning America."

ABC went on to report that there were 51 tornadoes across eight states on Monday—Idaho, Colorado, Nebraska, Iowa, Minnesota, Illinois, Indiana, and Ohio—and severe weather remains a threat through Wednesday.

Ohio, and some of its larger metros, are no strangers to these storms.

A Redfin report in April outlined the metros at most risk for a natural disaster, and three Ohio metros found their names on the list. Cleveland and Columbus, which is located 71 miles from Dayton, had a natural disaster ranking of 23. Cincinnati was close behind with a natural disaster ranking of 24. Cincinnati is located 54 miles from Dayton.

According to the Redfin report, Columbus and Cleveland have experienced a combined 138 tornadoes. Cincinnati has 46 on record and Columbus’ 78 tornadoes were tied for second most on the list with Atlanta, Georgia, and Minneapolis, Minnesota.

Those impacted by the storm also face the dangers of foreclosure. CoreLogic released a study in May that stated without proper insurance, many homeowners impacted by natural disasters such as tornadoes may be at increased risk of foreclosure. CoreLogic’s 2019 Insurance Coverage Adequacy Report reveals how underinsurance can leave an impact on the lending industry.

“The disruption of a family’s regular flow of income and payments, as well as substantial loss in property value, can trigger mortgage default; especially if homeowners are underinsured and cannot afford to rebuild,” said Frank Nothaft, Chief Economist for CoreLogic.

Disruption to income from natural disasters including wildfires, tornadoes, and hurricanes can lead to mortgage defaults, and CoreLogic notes that delinquency and foreclosures typically spike in an affected area following a disaster.

“The financial impact of underinsurance touches everyone; this is especially true after a catastrophic event where widespread property damage can cost billions of dollars,” CoreLogic stated in the report.

The Five Star Institute will host its Disaster Preparedness Symposium on July 31 in New Orleans, Louisiana. Natural disasters impact investors, service providers, mortgage servicers, government agencies, legal professionals, lenders, property preservation companies, and—most importantly—homeowners.

The 2019 Five Star Disaster Preparedness Symposium will include critical conversations on response, reaction and assistance, to ensure the industry is ready to lend the proper support the next time a natural disaster strikes.

ACES ENGAGE 2025 registration now open!

Join us at the Broadmoor in Colorado Springs on May 18-20, 2025.

DS News--Mike Albanese

A bill containing more than $19 billion in aid for disaster relief may not advance to President Donald Trump’s approval after Rep. Chip Roy (R-Texas) objected to the bill on Friday.

According to reports, Roy cities the lack of money for the border and the $19 billion price tag for his objections. He also objetece to the measure without all members getting a chance to vote on it.

Congress is in recess until June 3, and a vote on the bill appears unlikely.

It was reported earlier this month that U.S. Representatives were pushing for the allocation of promised disaster relief aid Texas and other disaster-affected states.

U.S. Reps. Randy Weber and Lizzie Fletcher, introduced the Bipartisan Disaster Recovery Funding Act last week, with support from 13 other co-sponsors from Texas, mostly from the Houston area, as well as supporters from other communities waiting on the funding, including Louisiana, South Carolina, Florida and Puerto Rico.

The Act directs federal agencies to release the $16 billion in disaster funds Congress approved in early 2018 following Hurricane Harvey to different states and territories—including more than $4 billion to Texas—within 60 days.

“After Harvey hit, I fought alongside the Texas delegation to secure additional funds for Harvey survivors,” U.S. Rep. Mike McCaul. “Unfortunately, the agencies tasked with distributing these funds did not respond with the same urgency.”

The Five Star Conference will host its Disaster Preparedness Symposium on July 31 in New Orleans, Louisiana. Natural disasters impact investors, service providers, mortgage servicers, government agencies, legal professionals, lenders, property preservation companies, and—most importantly—homeowners.

The 2019 Five Star Disaster Preparedness Symposium will include critical conversations on response, reaction and assistance, to ensure the industry is ready to lend the proper support the next time a natural disaster strikes.

FEMA-4435-DR-MO

• The President approved a Major Disaster Declaration for the State of Missouri on May 20, 2019 • For severe storms, straight-line winds, and flooding that occurred March 11 to April 16, 2019 • Provides: ○ Public Assistance for Andrew, Atchison, Buchanan, Carroll, Chariton, Holt, Mississippi, New Madrid, Pemiscot, Perry, Platte, Ray, and Ste. Genevieve Counties ○ Hazard Mitigation statewide

• The FCO is Seamus K. Leary

DSNews--Seth Welborn

U.S. Representatives are pushing for the allocation of promised disaster relief aid Texas and other disaster-affected states. U.S. Reps. Randy Weber and Lizzie Fletcher, introduced the Bipartisan Disaster Recovery Funding Act last week, with support from 13 other co-sponsors from Texas, mostly from the Houston area, as well as supporters from other communities waiting on the funding, including Louisiana, South Carolina, Florida and Puerto Rico.

The Act directs federal agencies to release the $16 billion in disaster funds Congress approved in early 2018 following Hurricane Harvey to different states and territories—including more than $4 billion to Texas—within 60 days.

“After Harvey hit, I fought alongside the Texas delegation to secure additional funds for Harvey survivors,” U.S. Rep. Mike McCaul. “Unfortunately, the agencies tasked with distributing these funds did not respond with the same urgency.”

According to the Texas Tribune, Texas has already received billions of dollars for Harvey recovery, but each bucket of money is designated for a specific purpose. The $4.3 billion that Congress approved for Texas last February is part of a HUD grant program designed "to help cities, counties, and States recover from Presidentially declared disasters, especially in low-income areas."

Hurricanes and Homeownership

According to a report from the Urban institute, natural disasters leave a negative impact on homeownership long afterward. Urban notes is that the negative effects of disasters persist, or even grow over time, for important financial outcomes. Urban’s report calls for lenders and government sponsored enterprises to update existing mortgage delinquency and foreclosure policies to account for these long-term financial burdens following disasters.

As part of a plan to further address affordable housing issues, and possibly address some of the issues put forth by the Urban Institute, House Financial Services Committee Chairwoman Maxine Waters included a plan for pre-disaster mitigation funds in a bill introduced on Tuesday. Part of the bill contains $5 billion to support mitigation efforts that can protect communities from future disasters and reduce post-disaster federal spending.

The additional funds may act as insurance for homeowners affected by natural disasters. According to data from Colorado State University, there is a 48% chance of coastal areas being hit by hurricanes making landfall this year, just slightly down from the century-long average of 52%. Homeowners without proper insurance in these areas are at high risk for default or foreclosure.

Learn more about how to prepare for natural disasters at the 2019 inaugural Five Star Disaster Preparedness Symposium, July 31 at the Hotel Monteleone in New Orleans. The Symposium provides an opportunity for national leaders and executives to engage in critical conversations on diligence and preparedness, so the next time a natural disaster strikes, the industry will be ready to lend the proper support. Register for the Symposium here.

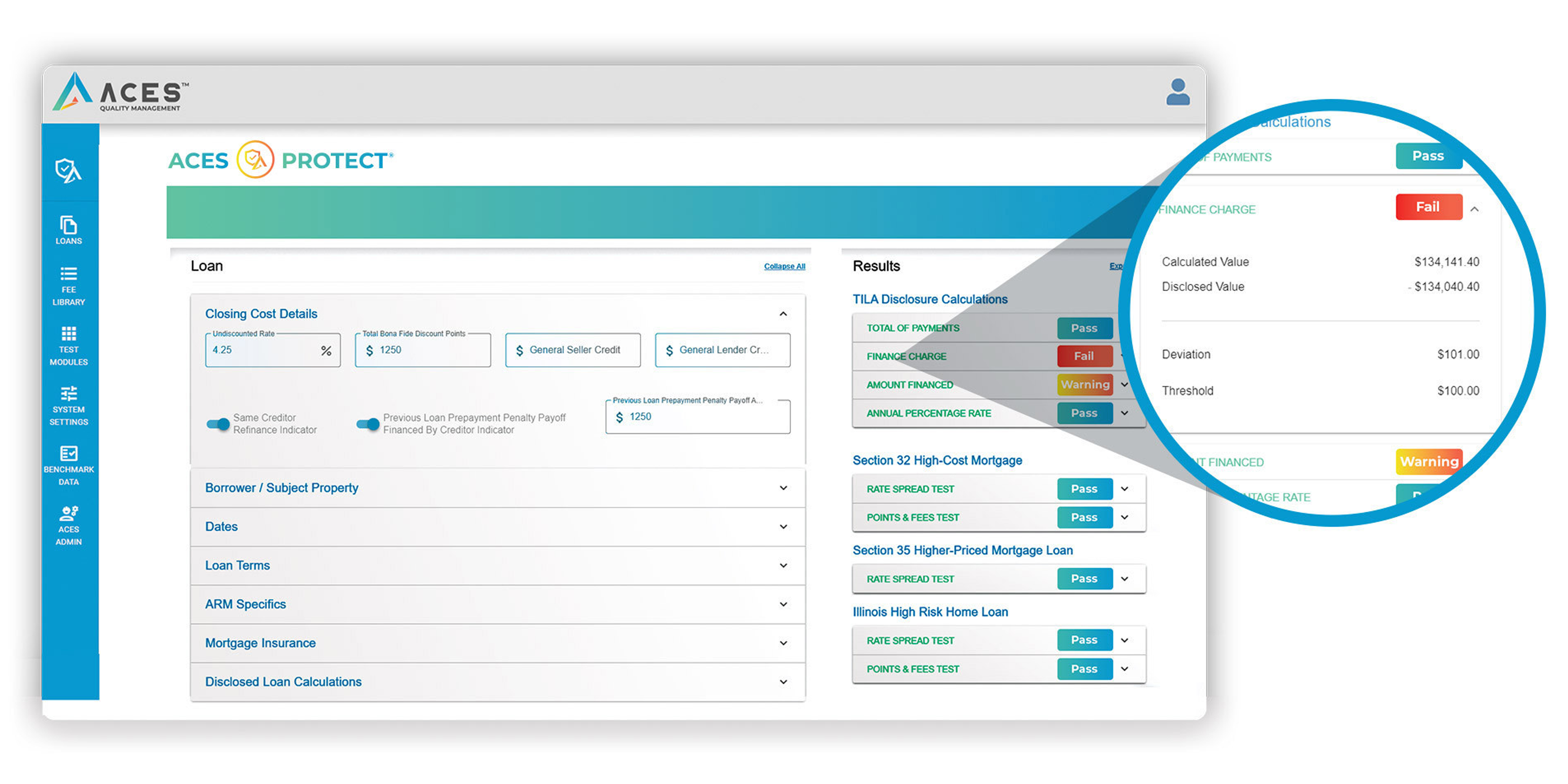

Automated compliance tests to ensure compliance on more loans in less time

DSNews--Seth Welborn

The source of California’s Camp Fire, which burned more than 150,000 acres and killed 85 people, has been identified as electrical transmission lines owned and operated by utility giant Pacific Gas and Electric (PG&E). The fire in Northern California's Butte County burned more than 150,000 acres and killed 85 people.

"After a very meticulous and thorough investigation, CAL FIRE has determined that the Camp Fire was caused by electrical transmission lines owned and operated by Pacific Gas and Electricity (PG&E) located in the Pulga area" of Butte County, California fire officials said in a statement.

According to analysis by CoreLogic, the Camp and Woolsey fires left behind a trail of losses between $15 billion and $19 billion after being contained in late November 2018. The report contains the updated residential and commercial loss estimates from the wildfires based on the latest post-containment perimeter of both the Camp and Woolsey Fires.

The analysis recorded a total loss in the range of $11 billion and $13 billion from the Camp Fire, the most destructive wildfire in the state’s history. Additionally, estimated losses from Woolsey Fire in Southern California are estimated to be between $4 billion to $6 billion. Residential and commercial properties account for building, content, and additional living expenses. The estimated losses include damage caused by fire, smoke, demand surge and debris removal.The residential loss from the Camp fire alone is between $8 billion to $9 billion. Woolsey fires ravaged infrastructure worth $3.5 to $5.5 billion in the residential space and $0.5 billion in commercial losses.

Since fire is covered under a standard homeowners’ policy, the majority of homeowners were likely to have some protection from the financial challenges surrounding recovery, the analysis indicated. As part of FEMA’s federal aid program to help those affected by the fire, a loan of up to $2 million was made available for business property losses not fully compensated by insurance.

The number of acres burned the past year is the eighth highest in U.S. history as reported through November 30, 2018. Per a CoreLogic report, a total of 11 western states in the U.S. had at least one wildfire that exceeded 50,000 burned acres; the leading states being California and Oregon.

Learn more about how to prepare for natural disasters at the 2019 inaugural Five Star Disaster Preparedness Symposium, at the Hotel Monteleone in New Orleans. The Symposium provides an opportunity for national leaders and executives to engage in critical conversations on diligence and preparedness, so the next time a natural disaster strikes, the industry will be ready to lend the proper support. Register for the Symposium here.

National Mortgage News--Brad Finkelstein

The potential for longer homeowner recovery times from hurricanes could hurt mortgage companies that need to advance funds to investors from missed payments.

The average recovery time for a property damaged by a hurricane has been 10.7 months, which means some borrowers in states affected by last year's storms are still in the repair stage, according to BuildFax's examination of 11 major hurricanes between 2000 and 2018. For more severe storms like Hurricanes Harvey and Irma in 2017, the rebuilding effort took over a year.

"However, the combination of hurricane activity and the implications of a slowing housing market could lead to even longer recovery timelines," the April Housing Health Report said.

Early meteorological forecasts are projecting a below-average season for hurricanes in 2019, but there is still a significant backlog of damaged housing from past storms to work through.

Nationally, there was a 2.45% year-over-year increase in existing home maintenance volume during the month, marking the first rise since October 2018. There was a 5.07% year-over-year decline in March.

"While there is always a spotlight on new construction, maintenance is also a must-watch indicator — it reflects the health of the existing housing stock, which comprises 90% of all U.S. properties," said BuildFax CEO Holly Tachovsky in a press release. "This month's maintenance gain is a positive sign amidst a housing slowdown and we'll be watching whether this activity remains stable over time."

In particular, maintenance activity in North Carolina and South Carolina rose 3.09% and 2.96%, respectively, compared with April 2018. The increase was attributed to repair work related to Hurricane Florence, which made landfall in September and resulted in higher mortgage delinquencies in both states.

(Even with forbearance programs because of natural disasters, any loan where the borrower misses a payment is considered delinquent for reporting purposes.)

Maintenance activity in Florida declined by 10.03% compared to the same month a year ago. However, that drop was largely related to the completion of rebuilding work associated with 2017's Hurricane Irma, which had a more severe effect on the state than the more recent Hurricane Michael. Repairs to damaged homes are still pending in the Florida Panhandle due to the 2018 storm.

"While Hurricane Michael was also significant, delayed aid packages have left the area without the means to rebuild as quickly, lessening this month's activity," the report said.

Meanwhile single-family construction authorizations continued to decline, down 8.23% on a year-over-year basis and 4.53% from March.

Remodeling volume, a subset of maintenance that includes renovations, additions and alterations, fell by 0.95% compared with the prior year.

MReport--Mike Albanese

Corelogic’s latest Loan Performance Insight report found that the amount of mortgages that were delinquent more than 30 days decreased slightly year-over-year by 0.8% to 4%.

The report states the nation’s overall delinquency rate has fallen on a year-over-year basis for the past 14-consecutive months. Fewer delinquencies attribute to the strength of loan vintages in the years since the residential lending market has recovered following the housing crisis.

In February, 11 metropolitan areas experienced small annual gains in their serious delinquency rates—mortgages that are more than 90 days delinquent. The largest gains were in four Southeast metros affected by natural disasters in 2018.

Panama City, Florida, had the nation’s highest serious delinquency rate of 2%. Every state, for the exception of Minnesota, saw a decrease in serious delinquency rates. Minnesota’s rate was unchanged from 2018.

Eleven Core Base Statistical Areas/Metros saw its serious delinquency rate increase, most of which were located on the East Coast.

"We are on track to test generational lows as delinquency rates hit their lowest point in almost two decades. Given the economic outlook, we are likely to see more declines over the balance of this year. Reflective of the drop in delinquency rates, no state experienced a year-over-year increase in its foreclosure inventory rate so far in 2019,” said Frank Martell, Corelogic's President and CEO.

The amount of homes in foreclosure saw a slight decline, falling to 0.4% in February 2019 from 0.6% last year. Corelogic also reported the amount of home more than 120 days past due fell to 1.1% from 1.7% in February 2018.

Unchanged were the share of mortgages that transitioned from current to 30-days past due, remaining at 1%. This stat peaked at 2% in November 2008 and was 1.2% in January 2007, just before the financial collapse.

Individual states are moving to improve the amount of homes being foreclosed. New Jersey Gov. Phil Murphy signed several new laws into effect last month aiming to curb New jersey’s foreclosure crisis.

“The foreclosure crisis has hurt our economy and jeopardized economic security of too many New Jersey families," Murphy said. "Our communities cannot succeed while vacant or foreclosed homes sit empty or while families live in limbo. I am proud to sign these bills into law [Monday] and get New Jersey closer to ending the foreclosure crisis."

Black Knight’s 2018 Mortgage Monitor report had New Jersey’s foreclosure rate at the end of 2018 at 1.77%, trailing only Mississippi (2.36%), Louisiana (2.05%), and West Virginia (1.81%).

Today, the Federal Housing Administration (FHA) issued a waiver of its policy on the timeframe for completing the inspection of properties prior to closing or submitting the mortgage for FHA insurance endorsement in the March 23, 2019, Presidentially-Declared Major Disaster Area (PDMDA) due to the Iowa Severe Storms and Flooding declaration (DR-4421) in Freemont, Harrison, Mills, Monona, Pottawattamie, Scott, Shelby, and Woodbury counties.

Mortgagees can find more information about FHA’s PDMDA policies, as well as the 203(h) Mortgage Insurance for Disaster Victims Program and the 203(k) Rehabilitation Mortgage Insurance Program, on the FHA Resource Center’s Online Knowledge Base.

Quick Links

Resources

Contact the FHA Resource Center: