National Mortgage News--Bloomberg News

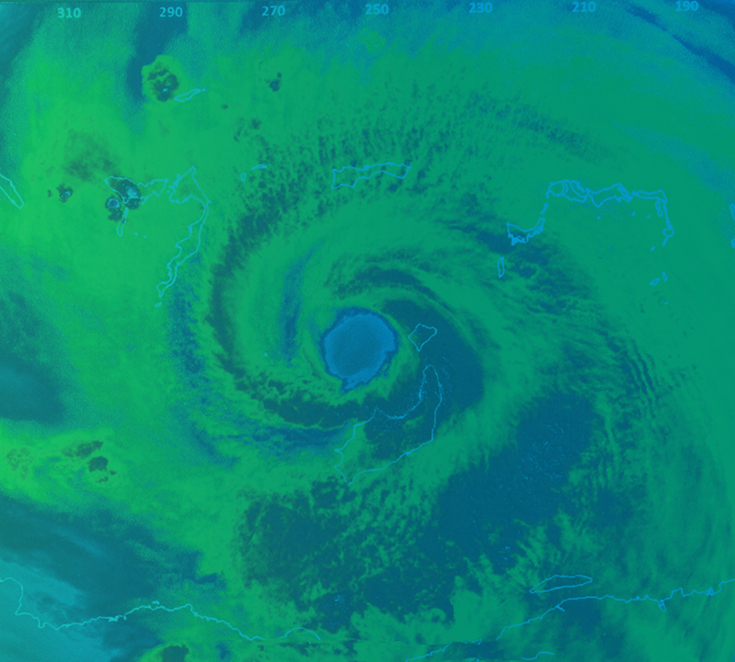

Hurricane Michael killed seven people and caused more than $6 billion in damage in Florida in October, a toll compounded by warmer, higher seas and wetter air, the signs of climate change scientists have long warned about.

But investors have yet to pay any kind of meaningful attention, buying up long-dated debt and financing real estate decades into the future. That kind of market neglect means the Florida economy can be expected to "go to hell," warned Spencer Glendon, a senior fellow at the Woods Hole Research Center and a former partner and director of investment research at Wellington Management.

"No one should be lending for 30 years in most of Florida," he said at an investment conference in New York last week. "During that time frame, insurance will disappear and terminal values" — future resale income — "will shrink. I tell my parents that it's fine to rent in Florida, but it’s insane to own or to lend."

Florida's economic crash could begin with banks or homebuyers worrying that annual insurance policies in some places will become prohibitively expensive, or disappear completely, Glendon said. That would shake the housing market and hurt property tax revenue, leaving Florida without an obvious way to pay for infrastructure to replace what's literally or figuratively under water.

Inability to replenish infrastructure in a slow-growth economy evokes community decay and economic decline reminiscent of Detroit or Puerto Rico, Glendon said. "I hope this is clear," he said in New York. "Civilization is built on climate stability. We are now accelerating into instability. Do your models reflect that?"

Trends in local municipal-bond and mortgage markets suggest they may not. The risks of climate change have begun to pop up in prospectuses and credit-analysis, to little effect. Ahead of a new debt offering last month, Miami Beach told potential investors that officials are "keenly aware of the risk from hurricanes and sea-level rise."

Miami Beach successfully raised its $162 million, with a 20-year maturity pricing at the same yield as a similar April offering by Charlotte, N.C., an inland city with much less climate risk. Both issues had the same call provisions, coupons and ratings from Moody's and S&P.

Comparisons are difficult, but if markets were acknowledging the scale of Florida-specific climate risk, Florida's bonds should sell at a discount, relative to similarly structured bonds sold elsewhere.

"I don't know whether the right price is half-price or 60% or 20%, but if it’s at 100%, I know it's the wrong price," Glendon said in an interview.

At the same time, climate risk may be subsumed by other incentives. People who buy property in Florida may value the tax-free income more than they worry about climate risk. When it comes to mortgages, the ultimate buyers of securitized loans are far removed from local officials and residents who know what’s happening on the ground.

Similar warnings are starting to reverberate among other financial institutions. BlackRock Inc. last month published a 20-page explanation of how climate-risk has become a necessary assessment in understanding shifting levels of risk and value.

The report concludes that 58% of U.S. metropolitan areas will face climate-related damages amounting to 1% or more of GDP by 2060-2080, and that "a rising share of muni bond issuance over time will likely come from regions facing economic losses from rising average temperatures and related events."

Bloomberg News