The Small Business Administration addresses questions related to good-faith errors made either by borrowers or lenders that result in loan amounts exceeding the eligible max. Borrowers may not receive forgiveness for excess loan amounts.

Compliance Newshub

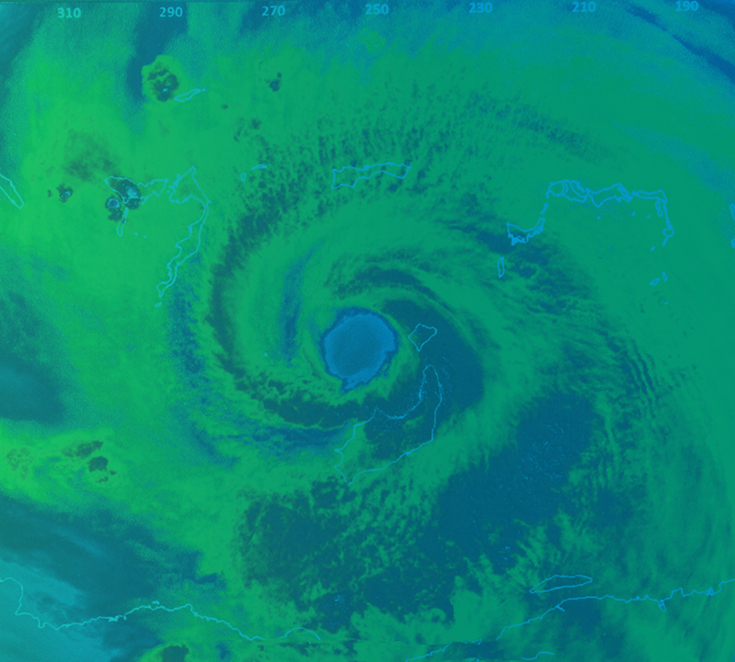

Disaster News

This topic consolidates the latest industry publications pertaining to natural disasters, including FEMA declarations, agency issuance's, and impact analyses from top industry providers.