FHA Mortgagee Letter 2020-45 extend the temporary guidance published in ML 2020-16, dated June 4, 2020, and extended in ML 2020-39, dated November 25, 2020, concerning endorsement processes for mortgages where a borrower has been granted a forbearance related to the Presidentially-Declared COVID-19 National Emergency prior to the loan being endorsed for FHA Insurance; through March 31, 2021.

Compliance Newshub

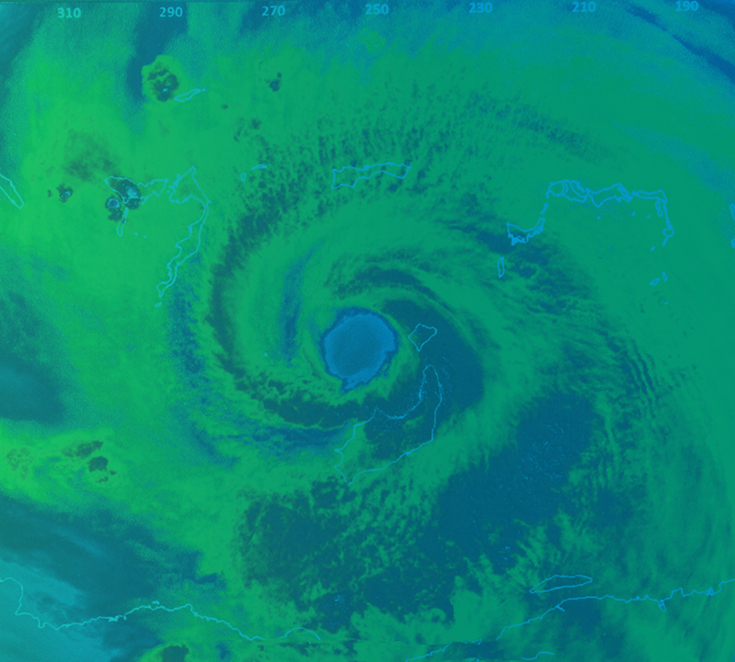

Disaster News

This topic consolidates the latest industry publications pertaining to natural disasters, including FEMA declarations, agency issuance's, and impact analyses from top industry providers.