FHA announces temporary waiver of quality control (QC) requirements for appraisals' filed reviews to provide mortgagees with flexibility.

Compliance Newshub

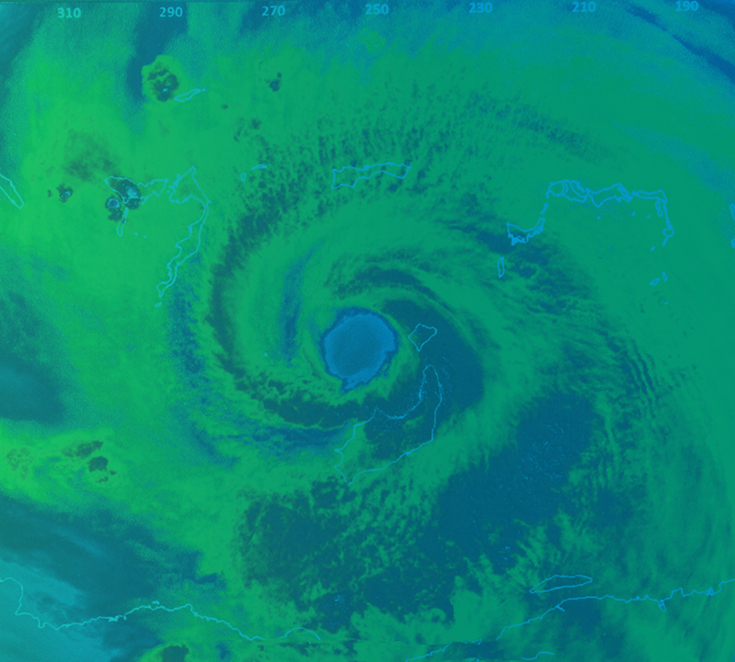

Disaster News

This topic consolidates the latest industry publications pertaining to natural disasters, including FEMA declarations, agency issuance's, and impact analyses from top industry providers.