ABA Banking Journal

During the American Bankers Association’s Risk and Compliance Virtual Conference to be held July 28-30, 2020, the CFPB Director Kathy Kraninger will deliver a live keynote address.

This topic consolidates legislative summaries of proposed and final regulatory rules impacting the mortgage banking industry today. This includes rules promulgated by federal regulatory agencies as well as up-to-the-minute legislative actions out of Washington, DC.

ABA Banking Journal

During the American Bankers Association’s Risk and Compliance Virtual Conference to be held July 28-30, 2020, the CFPB Director Kathy Kraninger will deliver a live keynote address.

The CFPB released The Elder Fraud Prevention and Response Networks Development Guide to help communities form networks to increase their capacity to prevent and respond to elder financial abuse.

Search our Compliance Calendar for current regulatory changes & updates.

MReport – Mike Albanese

The Federal Reserve announced, “ until it is confident,” the economy has recovered from the COVID-19, and the employment market is back on track; the interest rates will remain at 0 to .25%.

DSnews – Jason R. Bushby and Jonathan R. Kolodziej

Federal Financial Agencies, released at join statement announcing increasing flexibility in the mortgage servicing regulations.

The CFPB has issued a Factsheet on how to disclose title insurance on the Loan Estimate and Closing Disclosure, including when a negative owner’s title insurance cost disclosure is appropriate, as well as updated TRID FAQs to include guidance on the total of payments disclosure, using the optional signature line on the Loan Estimate and Closing Disclosure, and the requirement to include seller information on the consumer’s disclosures if providing separate Closing Disclosures.

Reuters – Howard Schneider, Jonnelle Marte

The U.S. Federal Reserve eased the terms of its lending program by cutting the minimum loan amount in half, extending the loan term, and encourage more businesses and banks to join in.

"We are already ahead of the game and without having to add additional FTEs."

- Julie Baril, QC Manager at Norcom Mortgage

MBA

After FHFA issues its quarterly Prepayment Report on the progress of Fannie Mae and Freddie Mac, they directed them to “further align their practices for evaluating seller and servicer prepayment related activities.”

OCC announced that on Monday, June 29, 2020, it would host a public meeting of the Mutual Saving Association Advisory Committee (MSAAC) via webinar.

The CFPB has updated the reverse mortgage servicing examination procedures to incorporate current U.S. Department of Housing and Urban Development (HUD) regulations that provide the structure for the Home Equity Conversion Mortgage product, as appropriate, and add new exam questions to encompass issues raised by older consumers in complaints.

The CARES Act, passed by Congress, provides individual renters protection for some tenants in federally subsidized or federally backed housing, and some states and local governments have also taken action to offer relief.

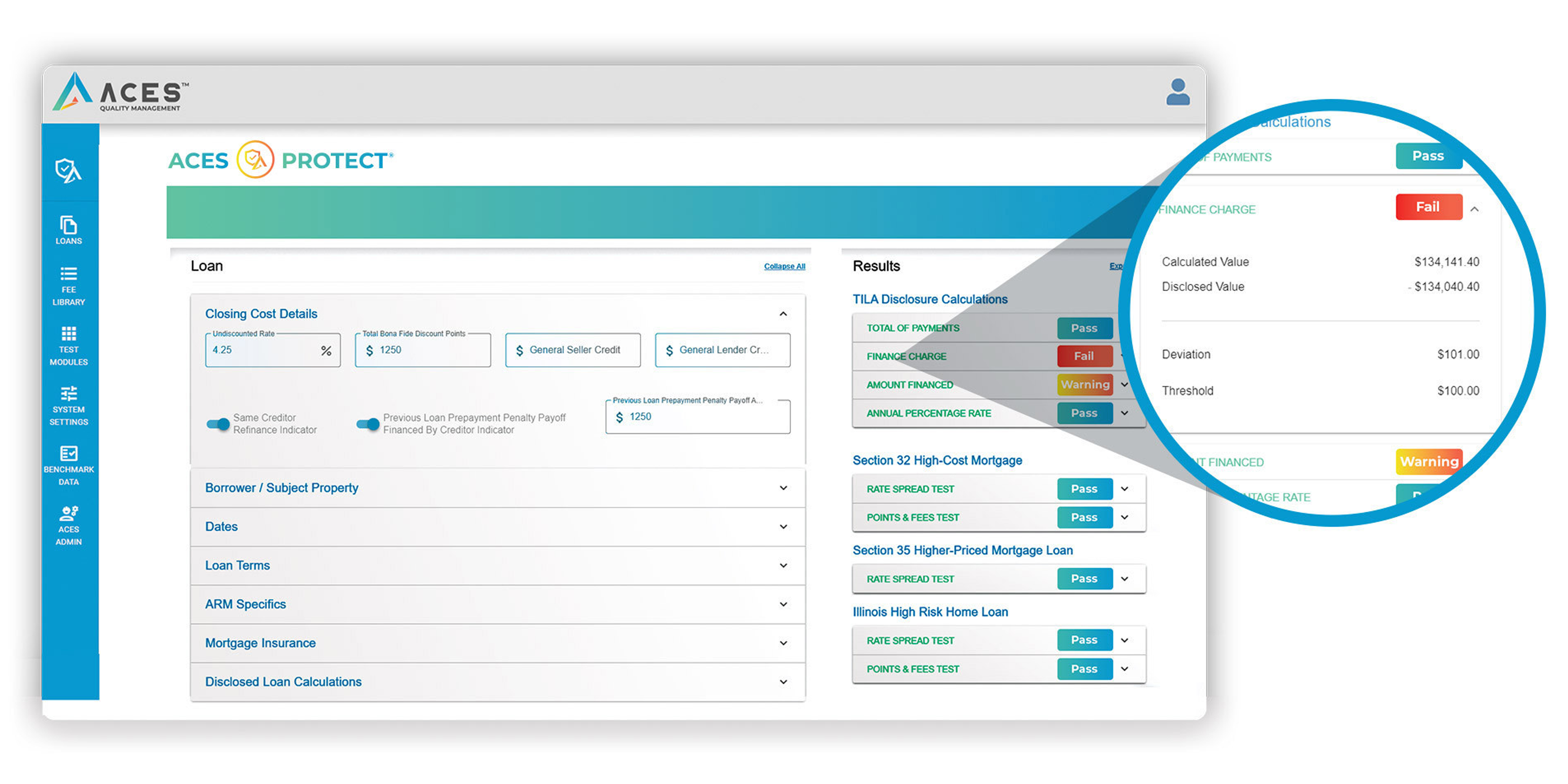

Automated compliance tests to ensure compliance on more loans in less time

The CFPB and the Conference of State Bank Supervisors issued joint guidance to mortgage servicers to assist in complying with the Coronavirus Aid, Relief and Economic Security (CARES) Act provisions granting a right to forbearance to consumers impacted by the COVID-19 pandemic.

The CFPB is providing temporary and targeted flexibility for credit card issuers regarding electronic provision of Regulation Z account-opening and temporary rate or fee reduction disclosures required to be in writing during the COVID-19 pandemic.

FHFA published a final rule that mandates Federal Home Loan Banks will no longer have their housing goals judged by Home Mortgage Disclosure Act data, but rather by a percentage of what loans they purchase; provides for a three-year phase-in period for the new goals.

CNBC--Jacob Pramuk

The Senate passed a resolution that changes the Paycheck Protection Program (PPP) to allow small businesses more flexibility in using PPP funds and repaying any money owed on a loan.