MBA Newslink--Bill Killmer; Pete Mills

This week's update includes information on FHFA's recall of proposed LLPA for DTI ratios and proposed amendments to the enterprise capital framework, legislature updates and more.

This topic consolidates the heartbeat of today's mortgage banking environment with news stories relevant to the financial compliance industry.

MBA Newslink--Bill Killmer; Pete Mills

This week's update includes information on FHFA's recall of proposed LLPA for DTI ratios and proposed amendments to the enterprise capital framework, legislature updates and more.

Housingwire--Bill Conroy

Independent mortgage banks are dealing with a surge of repurchase requests from Fannie Mae and Freddie Mac, where it is felt that the GSEs are being too aggressive in pursuing the repurchase option on loans with minor underwriting defects that could be cured without buyback demands.

Search our Compliance Calendar for current regulatory changes & updates.

MBA NewsLink - Mike Sorohan

The Federal Housing Finance Agency rescinded the debt-to-income-based loan-level pricing adjustment proposed in January.

Fannie Mae announced updates to the Fannie Servicing Guide, including changes to servicing responsibilities for mortgage loans with resale restrictions or shared equity provisions, automation of the Non-Routine Litigation Form, the New York consolidation, extension, and modification agreement, and the elimination of the MERS® system requirement for eMortgages.

MBA Newslink

This week’s update includes information about MBA requesting the CFPB to proceed with rulemaking to amend the Reg X Loss Mitigation procedures, CFPB proposing Long-Anticipated PACE Financing Rules, Florida Legislature approving MLO remote work, and more.

WRE News--Phil Hall

The New York State Assembly is actively considering a bill to raise the minimum borrower customer age to 62 from 60 to be eligible for a reverse mortgage.

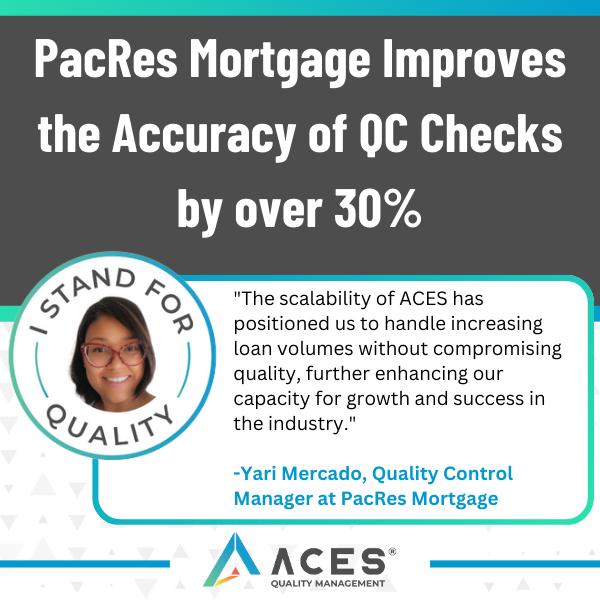

PacRes Mortgage Improves Quality Control Accuracy by over 30% While Decreasing non-compliance incidents by 25%

MBA Newslink

The updated SMART Doc® 1.02 Standardization Mapping and Implementation Guide includes guidance for creating consumer home equity first lien eNotes as well as mapping for consumer home equity first liens based on the 3200 Standard Fixed Rate Note form; the enhancements include guidance to increase interoperability and maintain data integrity when using eNotes for consumer home equity transactions, the public comment period runs through July 5.

Mortgage Professional America (MPA) - Fergal McAlinden

The Federal Reserve implemented its third increase of 2023, raising the Fed Funds rate from 5.00% to 5.25%.

HousingWire: Ensuring that creativity doesn’t compromise compliance takes serious research and constant QC system updating. We’ve asked Phillip McCall, president and chief operating officer at ACES Quality Management, how lenders can keep up with new and upcoming regulations to maintain loan quality in this very competitive environment.

This weeks update includes information relating to removing proposed LLPA for DTI ratios, CFPB reform legislation, housing challenges, and more.

ACES ENGAGE 2025 registration now open!

Join us at the Broadmoor in Colorado Springs on May 18-20, 2025.

DS News – Eric C. Peck

The Consumer Financial Protection Bureau (CFPB) has issued an interim final rule amending the agency’s 2021 LIBOR transition rule.

Housingwire--Brooklee Han

The Federal Reserve’s new FedNow, set to launch in July of this year, is meeting concerns from the title insurance industry that the benefit of speed, and being cheaper than wire transfers, may not outweigh the risks of fraud and irrevocable payments.

FinCEN announced renewed and expanded GTO's requiring US title insurance companies to verify identities of natural persons behind shell companies that are used to purchase residential real estate non-financed. Expansion includes Litchfield County in Connecticut and Adams, Arapahoe, Clear Creek, Denver, Douglas, Eagle, Elbert, El Paso, Fremont, Jefferson, Mesa, Pitkin, Pueblo, and Summit counties in Colorado. The effective period of the GTOs for purchases in these newly added areas begins on May 24, 2023. The terms of the comprehensive GTO's are effective through October 21st, 2023.

The CFPB posted an advisory opinion reminding debt collectors that it may be a violation of the Fair Debt Collection Practices Act to attempt to foreclose on silent second mortgages, also known as zombie mortgages. Zombie mortgages are second mortgages in which the statute of limitations has expired. This prohibition applies even if the debt collector is not aware that the debt is time-barred.